unemployment federal tax refund 2020

We make money from our state tax return and other optional services. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate.

. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. The IRS has sent 87 million unemployment compensation refunds so far. 2020 92969 or less.

The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such. Dont expect a refund for unemployment benefits. Ad See How Long It Could Take Your 2021 State Tax Refund.

HR Block does not provide audit attest or. They say dont file an amended return. Check For The Latest Updates And Resources Throughout The Tax Season.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. Americans who received unemployment compensation in 2020 may be eligible for a tax refund on any federal income tax paid on those benefits. Tax refunds on unemployment benefits to start in May.

Learn How Long It Could Take Your 2021 State Tax Refund. You receive excellent value. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

File 2019 Tax Return. If you received unemployment benefits in 2020 a tax refund may be on its way to you. If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied.

File 2018 Tax Return. The American Rescue Plan Act of 2021 excludes a certain amount of unemployment from your federal AGI for your 2020 tax year based on your. 2021 94178 or less.

The federal tax code counts jobless. File unemployment tax return. Offer valid for returns filed 512020 - 5312020.

COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable. File 2020 Tax Return. The first phase of refunds will go to taxpayers who are eligible to exclude up to 10200 of unemployment benefits from their federal taxable income.

Report unemployment income to the IRS. Your total annual income combined if you were married or in a civil union and lived in the same home was. New income calculation and unemployment.

I foolishly filed my tax return on the day they passed the legislation that excluded the first 10200 of unemployment income from federal taxes. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received. 22 2022 Published 742 am.

By Anuradha Garg. File 2017 Tax Return. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Learn more about this refund.

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Tax Refund Timeline Here S When To Expect Yours

Self Employed Tax Preparation Printables Instant Download Etsy Tax Preparation Tax Checklist Small Business Tax

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Do I Need To File A Tax Return Forbes Advisor

Tax Refund Timeline Here S When To Expect Yours

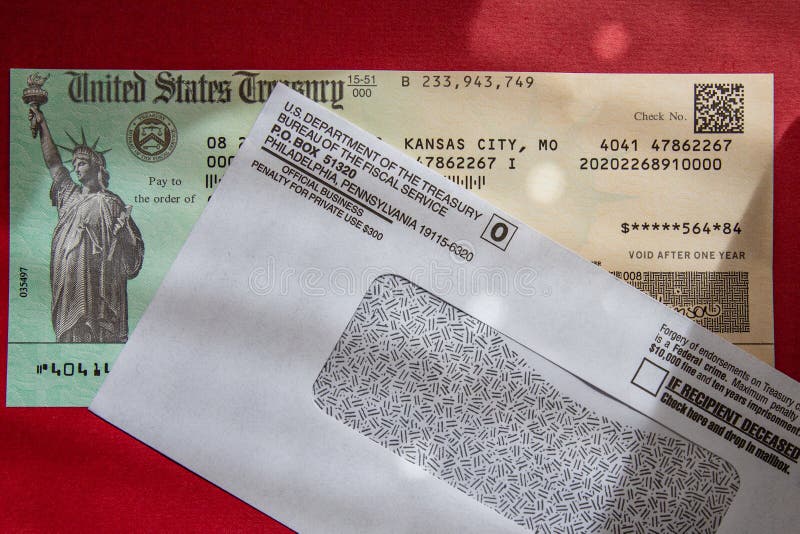

6 819 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

Stimulus And Taxes How To Shield Up To 10 200 In Unemployment Benefits From Income Taxes Syracuse Com

Irs Releases Draft Form 1040 Here S What S New For 2020 Irs Forms Tax Return Income Tax Return

How To Find Your Irs Tax Refund Status H R Block Newsroom

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Americans Should Be Prepared For A Smaller Tax Refund Next Year

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Tax Season 2021 Is Open And Comes With A Lot Of Issues The Washington Post

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax